When did you last go to the post office to send a letter or to the bank to make a financial transaction in person? In today’s digital age, data security has become paramount.

The Payment Card Industry Data Security Standard (PCI DSS) plays a pivotal role in ensuring the safety of cardholder data in the digital age. In this blog post, I’d like to review a few critical changes between PCI DSS 3.2 and PCI DSS 4 and discuss why compliance with PCI DSS is essential to your business.

I will also explore how Tufin can help you adapt seamlessly to these changes.

The Importance of PCI DSS Compliance

PCI DSS is a set of security standards designed to ensure all companies processing, storing, or transmitting payment card information maintain a secure environment. Complying with PCI DSS is essential for several reasons.

1. Protects Customers’ Data

Following the PCI DSS guidelines ensures that you’re storing, transmitting, and processing customer information, such as credit card numbers, in a secure manner.

By implementing various security measures, such as encryption, firewalls, and access controls, you can safeguard sensitive data from unauthorized access, reducing the risk of data breaches and identity theft. This protects customers from potential financial losses and maintains their trust and confidence in your business.

2. Bolsters Brand Reputation

Would you do business with a company that allowed your credit card data to become compromised?

In today’s digital age, a single data breach can have far-reaching consequences for a business’s reputation. When news of a security incident spreads, customers may lose trust in the brand, leading to declining sales and customer loyalty. Compliance violations can be widely publicized, damaging your image and causing long-term harm to your business.

By proactively complying with PCI DSS, businesses demonstrate their commitment to data security, reassuring customers that their payment information is safe. This builds trust, enhances your reputation, and sets you apart from competitors who may not prioritize data security.

3. Prevents Security Breaches

Beyond financial repercussions, data breaches can have severe security implications. Cardholder data can be exploited, causing harm to individuals and undermining cybersecurity.

Security teams can spend months cleaning up breaches. Determining all the paths a threat actor might have taken is difficult. Then, teams must spend time fortifying the security around exploited attack vectors. The vicious cycle is never-ending. Being PCI DSS compliant means having a solid security program in place. To prevent cyberattacks and potential financial disasters.

Beyond that, non-compliance can result in hefty fines. The costs associated with investigation, legal action, and potential lawsuits can be significant in a data breach. PCI DSS compliance is a more cost-effective route.

The Key Differences Between PCI DSS 3.2 and PCI DSS 4

On March 31, 2022, the PCI Security Standards Council (PCI SSC) unveiled version 4.0 of the PCI Data Security Standard (PCI DSS), presenting 64 additional requirements for organizations to adhere to. This global standard is a foundational set of technical and operational criteria to safeguard account data.

From Q2 of 2024 through Q2 of 2025, PCI DSS v4 will become required for all companies. There’s a deadline for PCI DSS v3.2.1 until March 31, 2024, giving enterprises enough time to get up to speed and implement the new standards.

Let’s explore some main differences between PCI DSS 3.2 and PCI DSS 4.

1. PCI DSS 4 Helps You Make Better Sense of Your Data

PCI DSS 4 highlights the importance of interpreting your data effectively. It’s no longer enough to collect information such as logs, traffic, and system events from multiple security controls; you must put in place a process that takes these data points into qualitative, actionable insights.

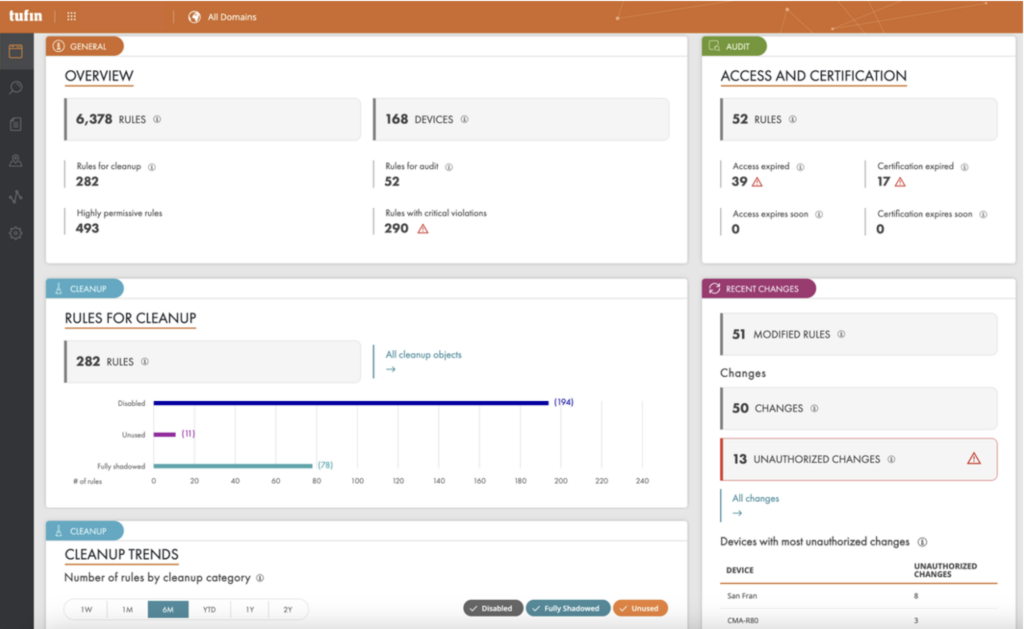

Tufin’s SecureTrack+ provides comprehensive visibility into your network access controls configuration and posture. Tufin SecureTrack+ processes data from all your security access controls (e.g., Firewalls, Security Groups, and more), as well as from the network devices (e.g., routers, switches, transit gateways, and more) and transforms it into actionable insights allowing you to make informed decisions about your security posture.

2. PCI DSS 4 Places Higher Focus on Security Outcomes

PCI DSS 4 shifts its focus from security standards to security outcomes. An example of such may encourage organizations to conduct a risk assessment before implementing changes to various guardrails or beginning to enforce security controls.

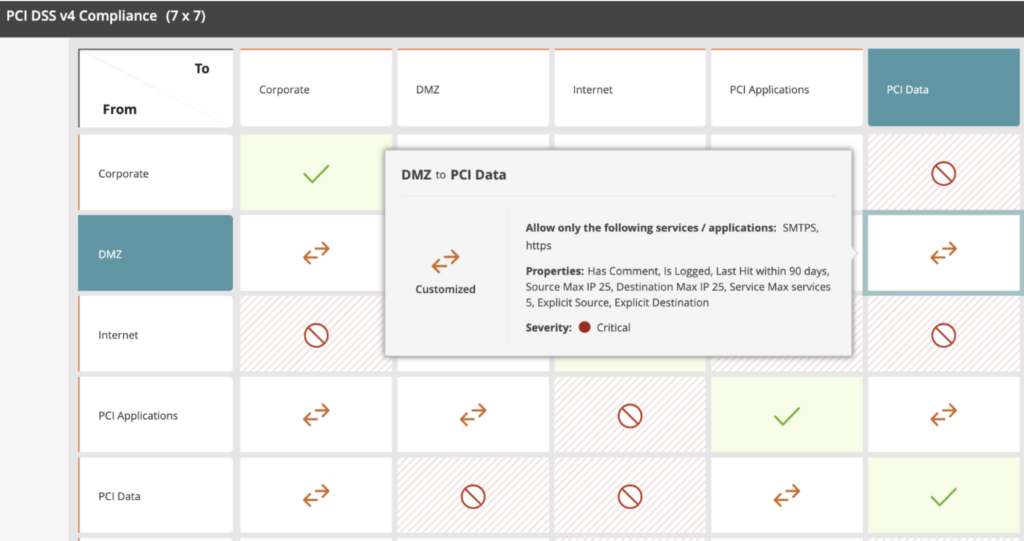

Any change in access in the network must go through various security validations before proceeding to implementation. For example, changing or implementing an access rule in a corporate policy may be outside your PCI segmentation policy scope. You will want to identify these types of PCI violations before making a change or at least understand that you are about to cause a security policy violation and obtain necessary approvals.

Tufin’s SecureChange+ assesses associated risks and calculates their impact on compliance, PCI 4 amongst them, with any network access request before the change is made. That way, organizations can avoid continuously introducing new risks or security policy violations into their desired network security standards.

In software development, making these validations before change happens is usually called shifting security left – a network security practice Tufin has championed for over ten years.

3. PCI DSS 4 Focuses on Endured Security and Compliance—Not Point-in-Time Alignments

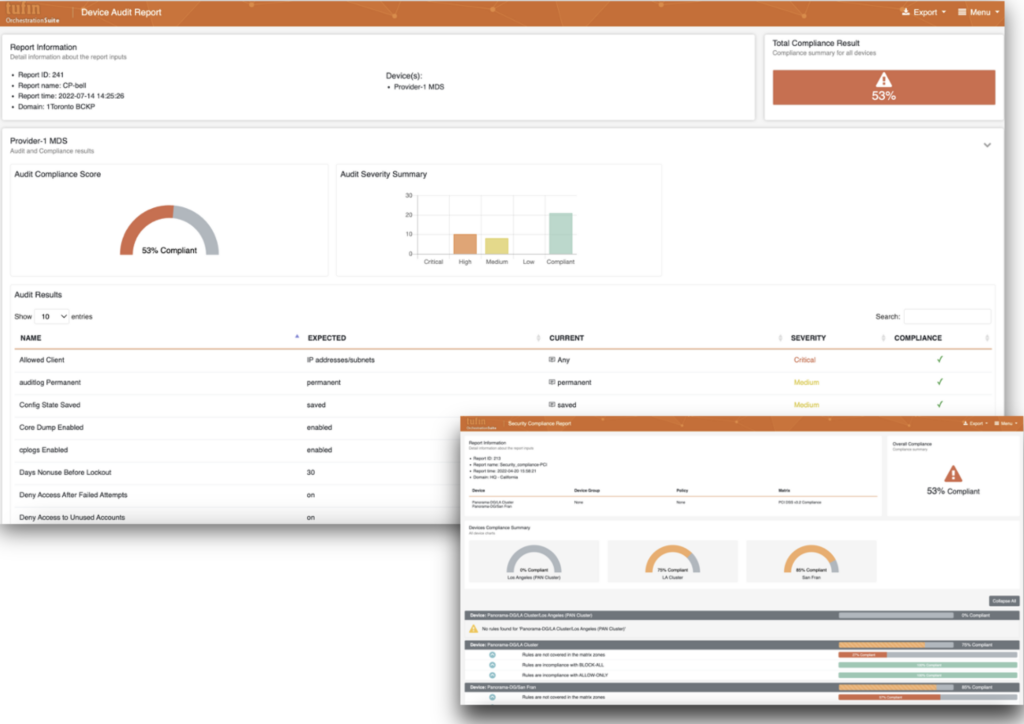

PCI DSS 4 encourages enduring security and compliance, moving away from point-in-time assessments. Not only do you need to show resilience during an audit, but you must also validate your compliance state regularly at any point in time.

PCI DSS 4 embraces the notion that transforming your security posture program from reactive to proactive in continually assessing and maintaining compliance increases audit readiness and assurance. This is a significant shift in how you manage and react to security policy violations by looking at them from a more strategic point of view.

Can you imagine being able to report to auditors, the GRC, and boards that you’re remaining continuously compliant?

- Tufin helps organizations achieve network security audit readiness using a unified security policy (USP) approach that constantly monitors the various access controls in your network and transmits customized alerts that help you stay on top of violations, risks, and more.

4. PCI DSS 4 Emphasizes the Change Management Processes

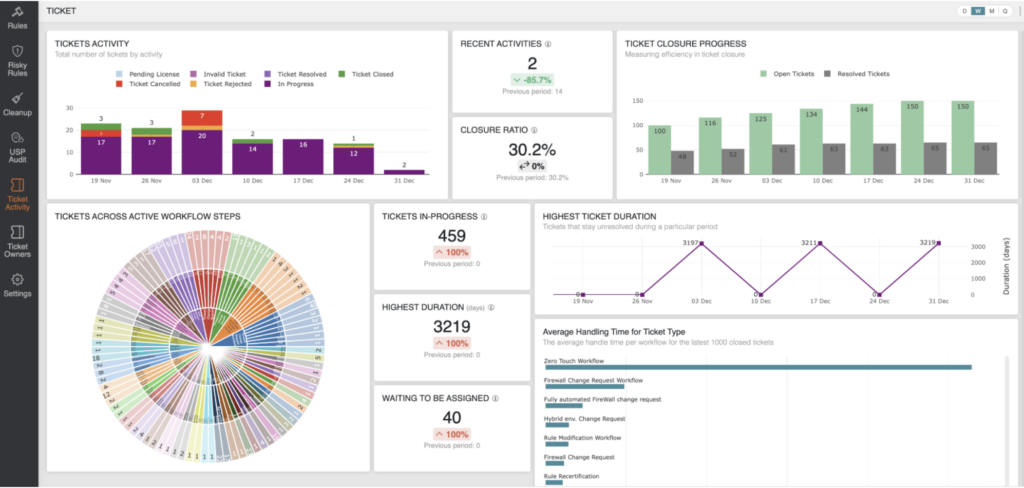

You need to establish a change management process to enable access to your network. Change management processes are nothing new but require tremendous technical and logistical effort across the organization.

Whether it’s a simple access rule change or a complicated application deployment process, your change management process should encompass everything within your network involving PCI data.

Tufin’s automated solutions standardize and streamline your change management processes, customizing them to meet your organizational needs.

Whether being at the forefront of the change mechanism or used as the backend engine behind your current ITSM system, Tufin helps automate all the processes involving a change in your network’s access controls, ensuring security and agility.

With such an approach, you can do the following:

- Reduce the likelihood of errors

- Ensure consistency in your compliance status

- Enhance the overall efficiency of your network security team

PCI DSS 4: The Proactive Approach

PCI DSS compliance is an ongoing process, and adapting to the changes between version 3.2 and 4 is crucial for your business.

PCI 4 shifted towards a more proactive approach to security, increased focus on authentication and authorization, stricter requirements for service providers, expanded scope for protecting sensitive data, and the inclusion of new technologies like cloud computing and mobile payment applications.

These changes aim to strengthen data security, mitigate risks, and adapt to the evolving threat landscape in the payment card industry.

Tufin can help you make this transition smoother, enabling you to maintain a robust security posture, avoid costly fines, and protect your reputation.

Don’t wait until a breach occurs – take proactive steps to secure your cardholder data and protect your business today!

Ready to Learn More

Get a Demo