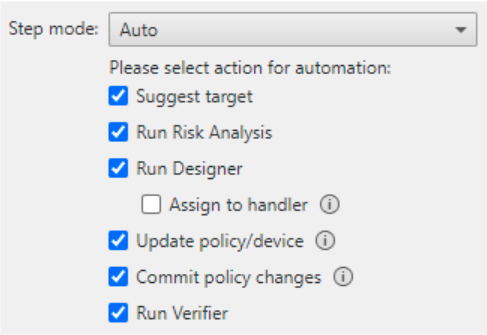

Tufin automates security policy configurations across various vendors and platforms, helping financial institutions manage their network security policies efficiently. Automation speeds up the process of implementing policy changes, reduces manual errors, and ensures compliance with regulatory standards.

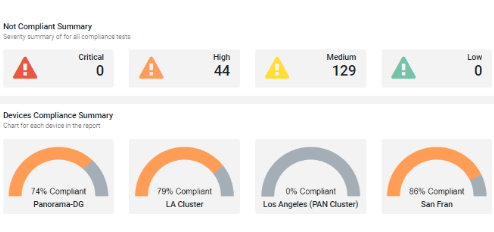

By providing continuous compliance reports and real-time alerts for non-compliance issues, Tufin enables financial organizations to maintain adherence to regulations such as PCI DSS, NCUA and GDPR.

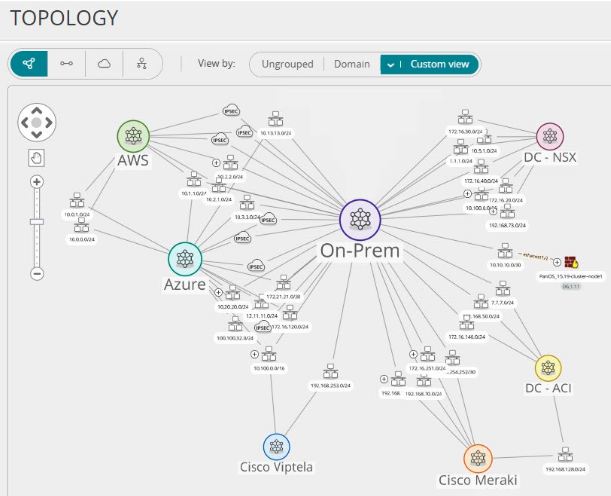

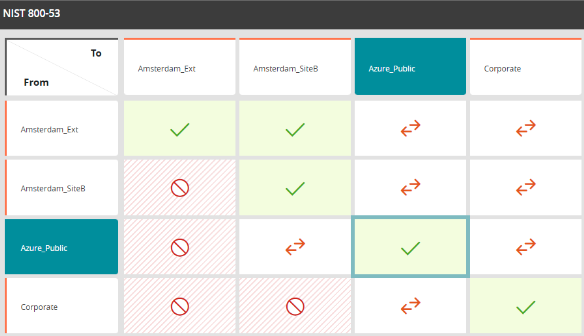

Tufin offers comprehensive visibility into network security policies across both on-premises and cloud environments that enables financial services to monitor and manage security policies effectively across their entire network landscape.

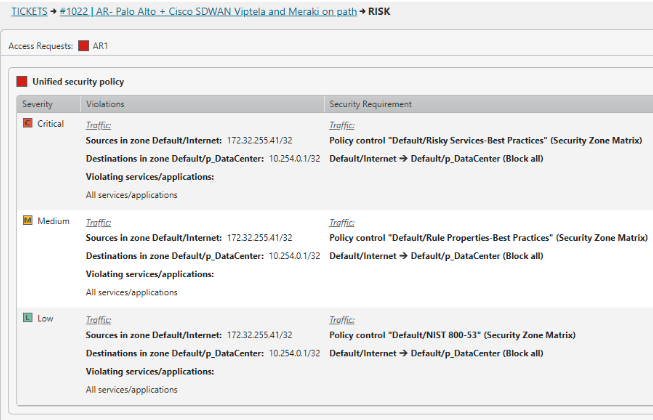

By analyzing the impact of network security changes before they are implemented, Tufin helps financial institutions reduce vulnerabilities and avoid potential risks associated with policy modifications. This preemptive analysis can prevent disruptions and security breaches that might result from misconfigured policies.

Tufin supports robust network segmentation and enforces access controls, which are critical for protecting sensitive data in financial services. By managing and optimizing firewall rules and access policies, Tufin ensures that only authorized users and systems can access critical financial resources, minimizing the risk of insider threats and external breaches.

Tufin offers pre-built integrations with all major network and cloud security vendors that help manage, monitor, and modify network security policies from one unified location.